Have ever wondered how your valuables like home, car, jewelry would remain protected against theft in case you’re away from home? That’s when general insurance would come into focus. If you want to protect your tangible assets from damage or loss, read how insurance will help you do so with ease.

You may have a life insurance policy that commits to secure the future of your loved ones in case of your sudden death. Just like it is necessary to safeguard one’s life from unforeseen events, similarly, you can also choose to protect your assets like motor, health, home, and others by purchasing a general insurance policy.

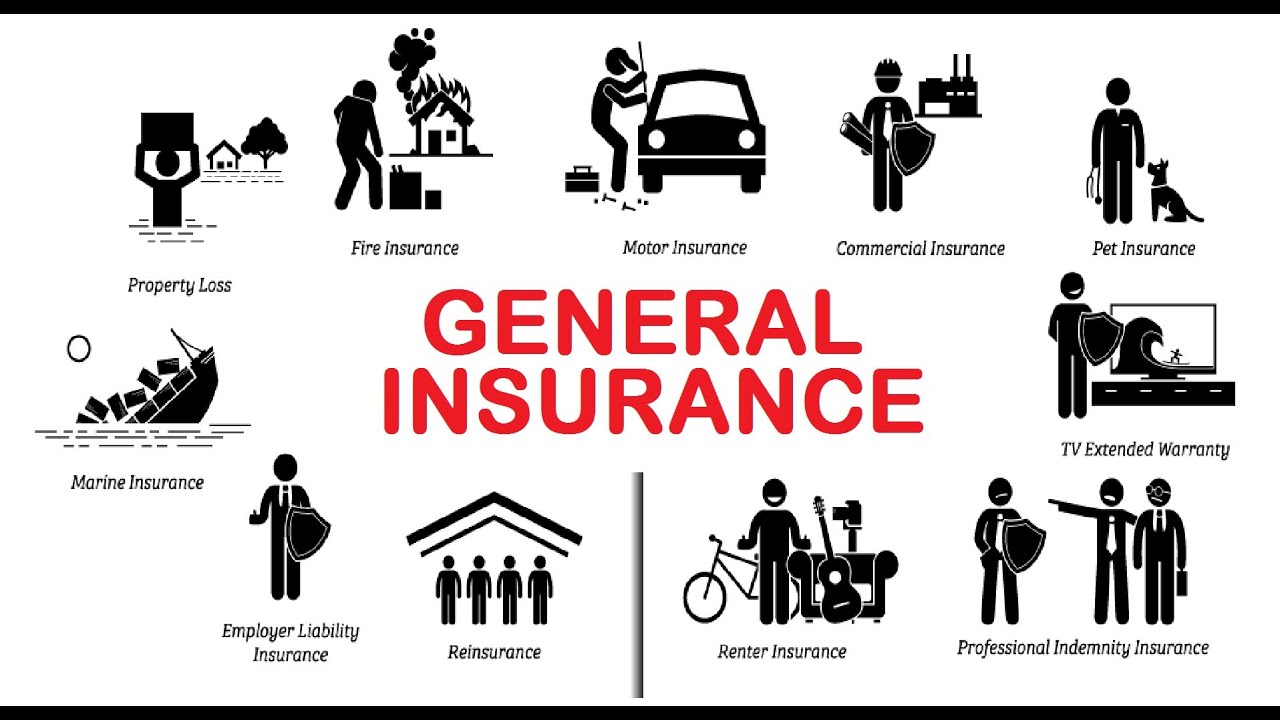

General insurance is an agreement between a policyholder and insurer wherein the insurance company protects your valuable assets from fire, theft, burglary, or any other unfortunate accident.

Often, general insurance is confused with life insurance. But, the two terms have vast differences. Let’s understand better with the table below:

| General Insurance | Life Insurance |

|---|---|

| Covers non-life assets | Covers life of an individual |

| It is not a type of savings | This insurance helps you accumulate savings for future |

| Annual contract with a lump sum premium | Long-term contract with the option of installment premiums |

| Pays sum assured in case of an eventuality such as theft or accident | Pays sum assured to the nominee in case of the death of the policyholder |

General insurance should be your priority as your assets may get damaged due to an accident or theft. Let’s understand its importance with an example:

Mr. ABC has got a new car, and he is slated to hit the roads. But while driving, his car suddenly gets hit by the other vehicle trying to overtake. This dislocates the left mirror of his car. Mr. ABC is stress-free as he has motor insurance, which will provide financial cover for the damages and he doesn’t have to pay for the damages.

This shows how general insurance can help to eliminate the dent in your pocket by providing cover for tangible assets.

There are various types of general insurance; these include:

Motor Insurance :: Motor insurance is a mandatory requirement if have a car, motorcycle or scooter. You will have to pay a fine and have your vehicle registration certificate (RC) or driving license (DL) confiscated by the police, if you are driving without a valid motor insurance or a motor insurance policy that has expired.

There are two types of motor insurance - third party insurance and comprehensive insurance. Third party insurance is mandatory for all vehicle owners in India. Third-party insurance will cover your liability towards damages incurred by the third party in case an accident happens with your vehicle. It won't cover damages to your vehicle. Comprehensive motor insurance provides your vehicle complete end-to-end protection against damage caused by accidents or natural disasters like floods etc.

Motor insurance premium depends on the price of the car (in case of a brand new car) or the Insurance Declared Value (IDV) of a car that has completed more than 1 year. Motor insurance is usually valid for a year; you must renew or get a new motor insurance policy before expiry of your current motor insurance. Some motor insurance policies can cover you for multiple years.

Travel insurance :: Travel insurance provides financial protection against possible losses that you may suffer when you are travelling by air, especially in overseas travel. It covers you against financial losses due to loss of baggage, trip cancellation, and flight delays. Some travel insurances also cover medical expenses that you may have to incur while travelling.

Home insurance :: As the name suggests, home insurance provides financial protection against damages caused to your home and its contents (furniture, home appliances etc) due to man-made (e.g. fire) or natural disasters (e.g. flood, earthquake etc).

Disability Insurance :: Provides income replacement in case of a disabling injury or illness that prevents the policyholder from working.

Long-Term Care Insurance :: Helps cover the costs of long-term care services for the elderly or those with chronic illnesses.

Specialty Insurance :: Includes policies for specific needs, such as flood insurance, earthquake insurance, and collector's item insurance.

DISCLAIMER -

Insurance is the subject matter of the solicitation. While every effort has been made to ensure that the information given is correct, the author does not hold himself liable for any consequences, legal or otherwise, arising out of use of any such information.